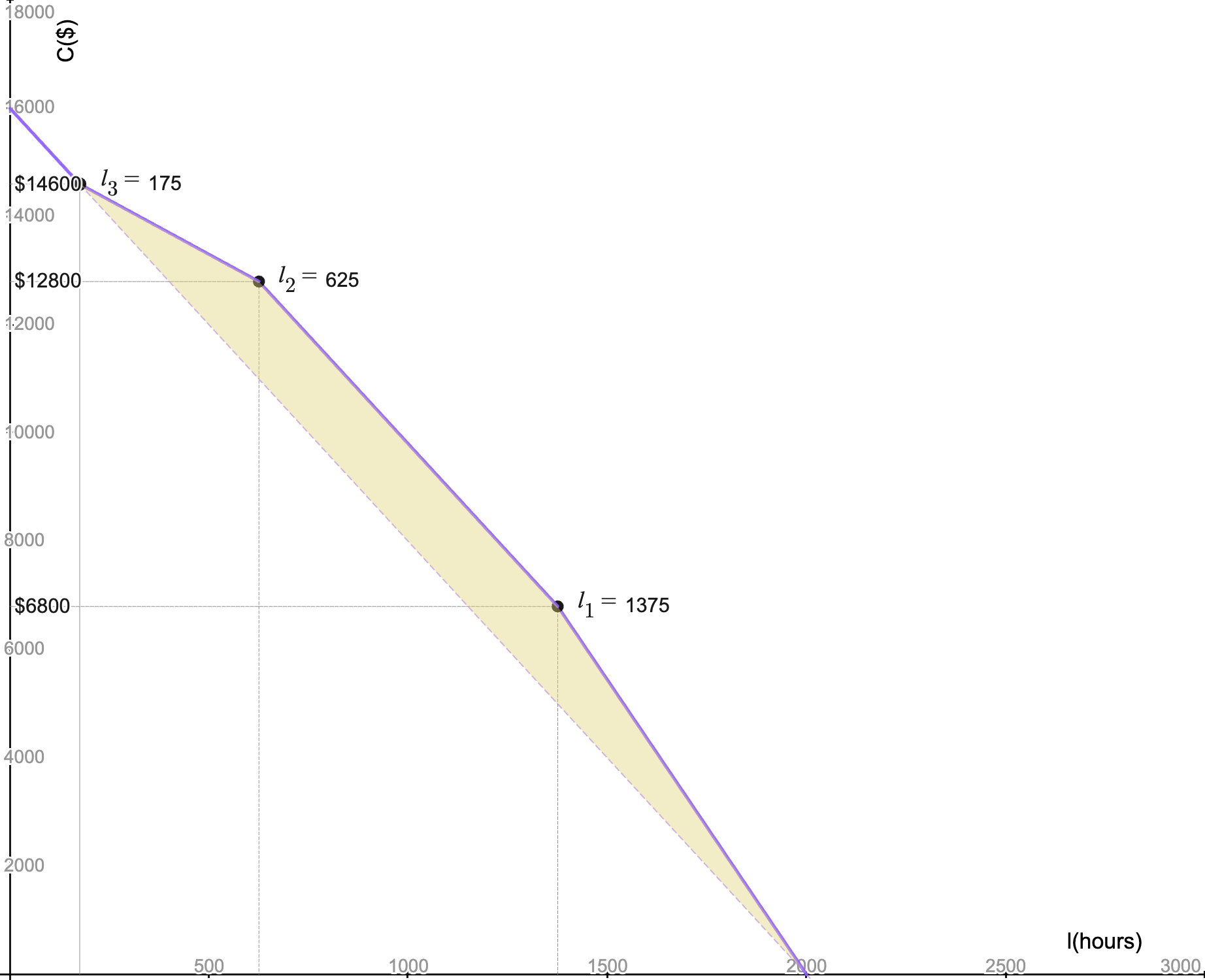

EITC Consumption-Leisure

modeling labor supply responses to Earned Income Tax Credit phase-in/out regions

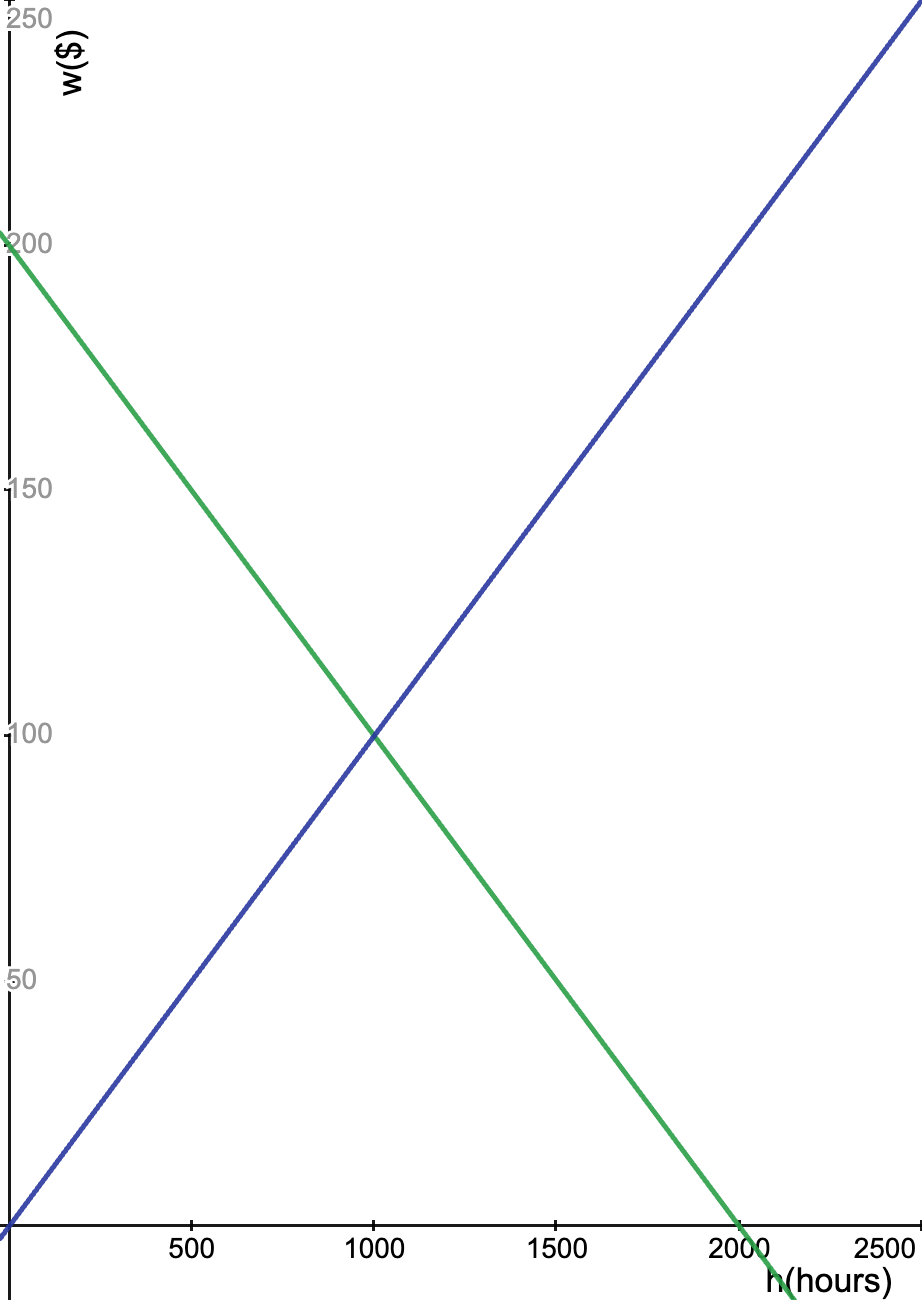

Progressive Tax Rich Vs Poor

Analyzing differential deadweight loss impacts of taxing higher versus lower income groups

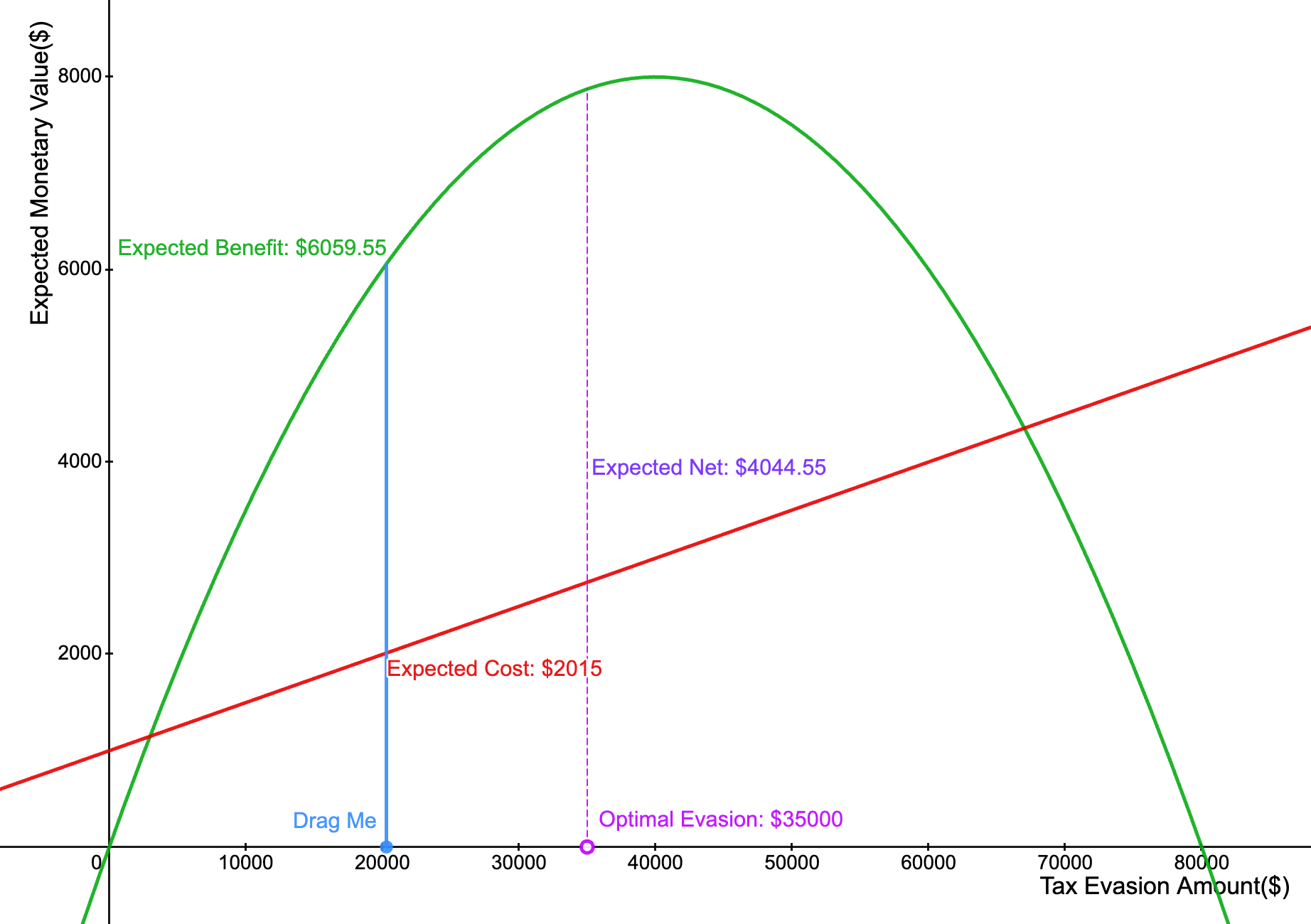

Risk-Neutral Tax Evasion Decision-Making

Optimizing evasion amount where marginal benefit equals marginal cost of detection risk

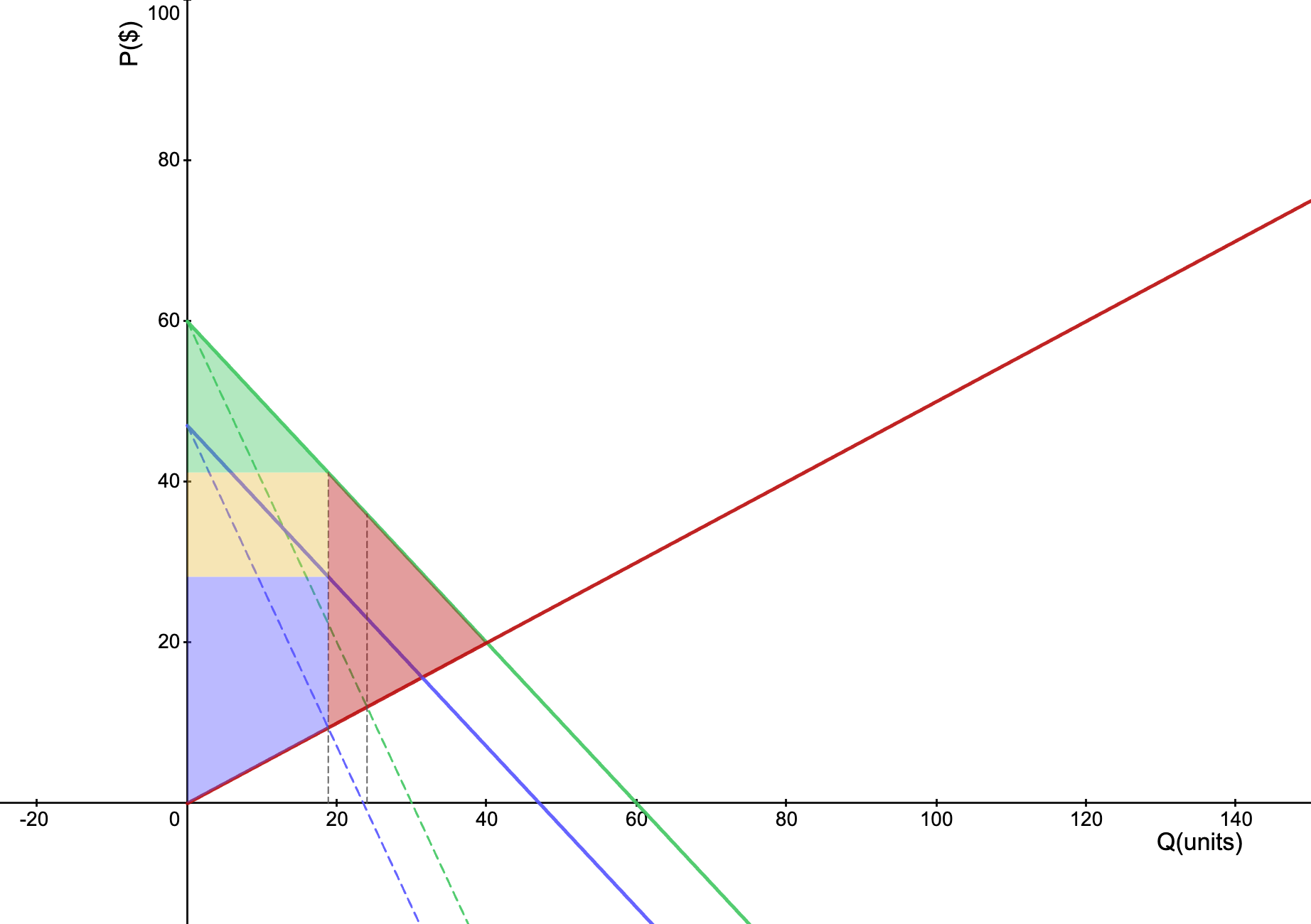

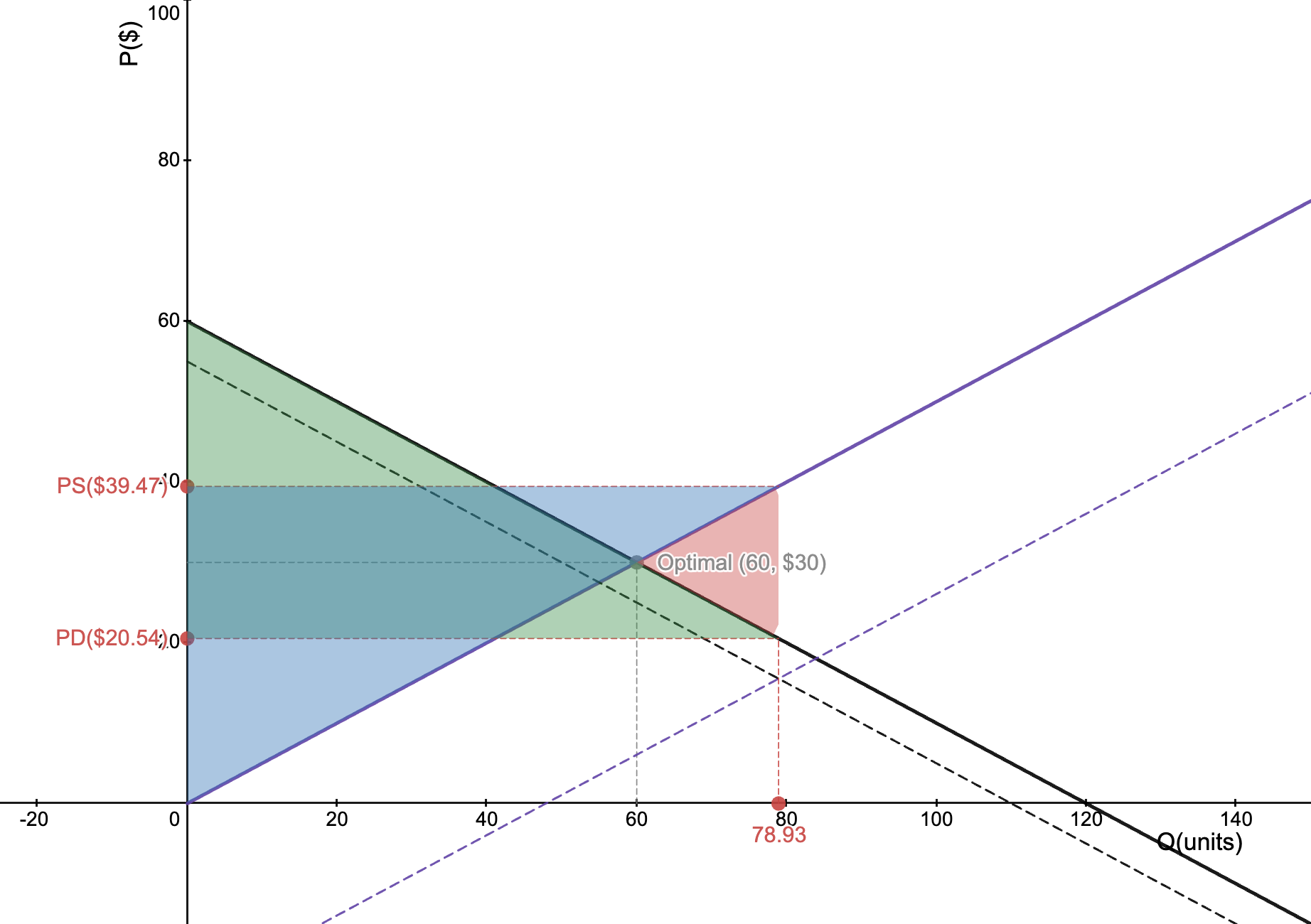

Tax Incidence in Monopoly

Visualize the impact of taxation on market outcomes using interactive graphs

Tax Incidence

Distributional burden of taxes between consumers and producers from demand/supply shifts